Huawei is quietly dominating China’s semiconductor supply chain - Mercator Institute for China Studies (MERICS)

Abstract

The Mercator Institute for China Studies (MERICS) reports that Huawei is strategically seizing control of China’s domestic semiconductor supply chain, largely circumventing the impact of stringent U.S. sanctions. This dominance is achieved through widespread investment via its vehicle, Hubble Technology Investment, funding hundreds of companies across critical sectors like materials, EDA, and manufacturing equipment. Huawei's strategy aims to build a vertically integrated, self-sufficient national ecosystem capable of producing chips independent of foreign technology and intellectual property.

Report

Huawei's Quiet Domination of China’s Semiconductor Supply Chain

Key Highlights

- Strategic Resilience: Huawei's primary driver is achieving full self-sufficiency and supply chain resilience (SSCR) following crippling U.S. sanctions that cut off access to advanced foundry services and critical software/IP.

- Investment Vehicle: Huawei is leveraging Hubble Technology Investment to aggressively invest in and partner with hundreds of small and medium-sized Chinese semiconductor firms, effectively buying its way into critical nodes of the supply chain.

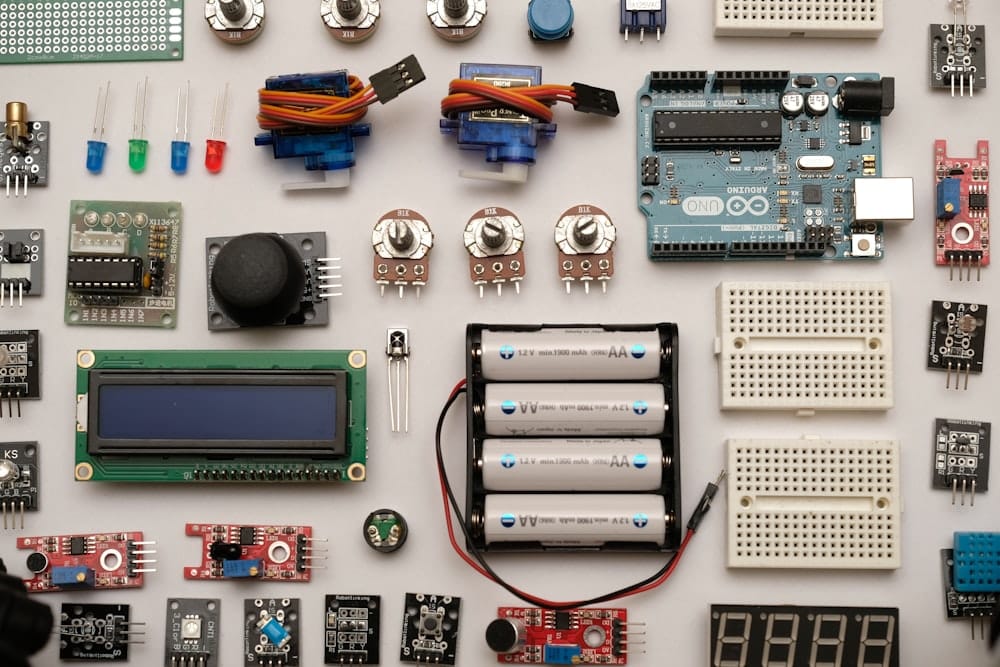

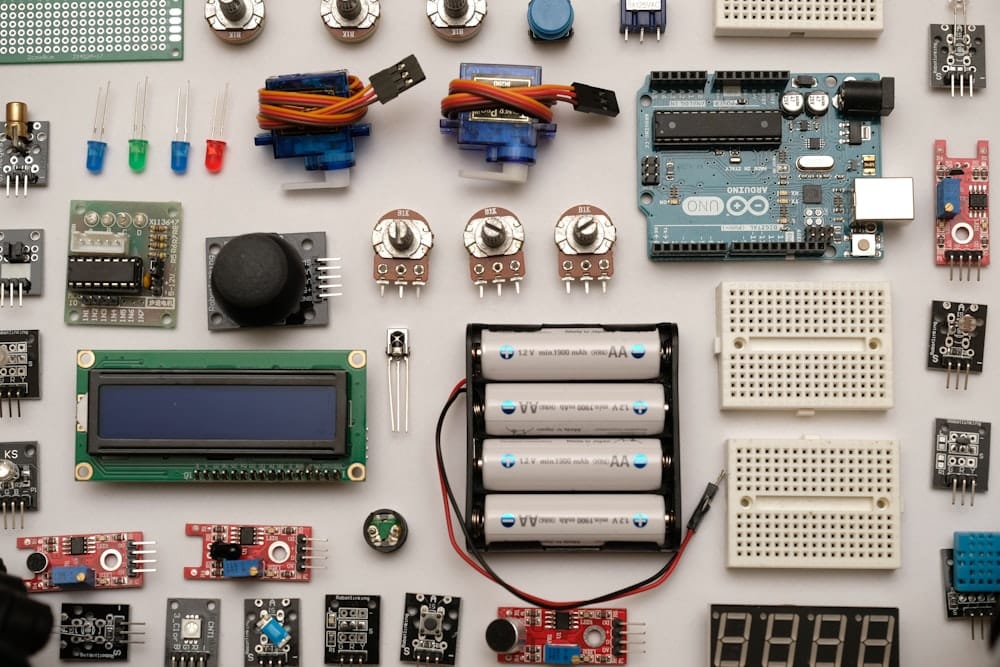

- Vertical Integration: The focus extends far beyond traditional chip design (HiSilicon) into foundational technologies, including chip manufacturing equipment, raw materials, Electronic Design Automation (EDA) tools, and specialized component makers.

- National Champion Role: Huawei is positioned as the central architect and driver of China's national semiconductor industrial policy, ensuring that domestic standards and technologies are prioritized and rapidly scaled.

- Ecosystem Control: By strategically distributing funding and R&D support, Huawei is effectively creating a captive supply ecosystem where its requirements and designs become the de facto standard for domestic Chinese suppliers.

Technical Details

- EDA Tooling: Significant investment is directed toward local EDA providers to replace market leaders like Synopsys and Cadence, aiming for full domestic capabilities in designing complex integrated circuits.

- Process Nodes: While the immediate focus is on ensuring reliable domestic production in mature nodes (e.g., 28nm and above), Huawei is funding research into materials science and equipment necessary for advancing local foundry capabilities (like SMIC) toward 7nm and 5nm processes despite equipment restrictions.

- Architecture Diversification: Huawei is likely expanding its use of architectures like RISC-V in embedded systems, microcontrollers, and IoT devices to reduce reliance on royalty-bearing foreign IP (like ARM) for non-critical components, while still driving domestic high-performance CPU designs.

- Advanced Packaging: Investments also target advanced packaging and testing facilities, crucial for maximizing performance and yield from domestically sourced silicon, particularly as traditional miniaturization faces bottlenecks.

Implications

- Accelerated Decoupling: Huawei's deep integration accelerates the bifurcation of the global tech ecosystem, leading to a robust, parallel Chinese supply chain that operates entirely outside of Western control and standards.

- RISC-V Ecosystem Boost: While not directly mentioned as the sole focus, Huawei's push for domestic IP and royalty-free architectures strongly benefits the RISC-V ecosystem in China. RISC-V becomes a critical component of the strategy to avoid future IP risk associated with proprietary Western designs.

- Market Barrier: Huawei's central role creates significant hurdles for foreign semiconductor equipment, materials, and IP vendors seeking access to the Chinese market, as the domestic ecosystem increasingly favors companies funded by Hubble or those aligned with Huawei's standards.

- Geopolitical Impact: This domestic dominance reinforces China's technological sovereignty goals, complicating international export controls and forcing Western governments to re-evaluate the effectiveness of sanctions when faced with massive, unified national efforts toward independence.

Technical Deep Dive Available

This public summary covers the essentials. The Full Report contains exclusive architectural diagrams, performance audits, and deep-dive technical analysis reserved for our members.